So what happened?

Federal Fund Rate remain the same. Hopes for rise in March.

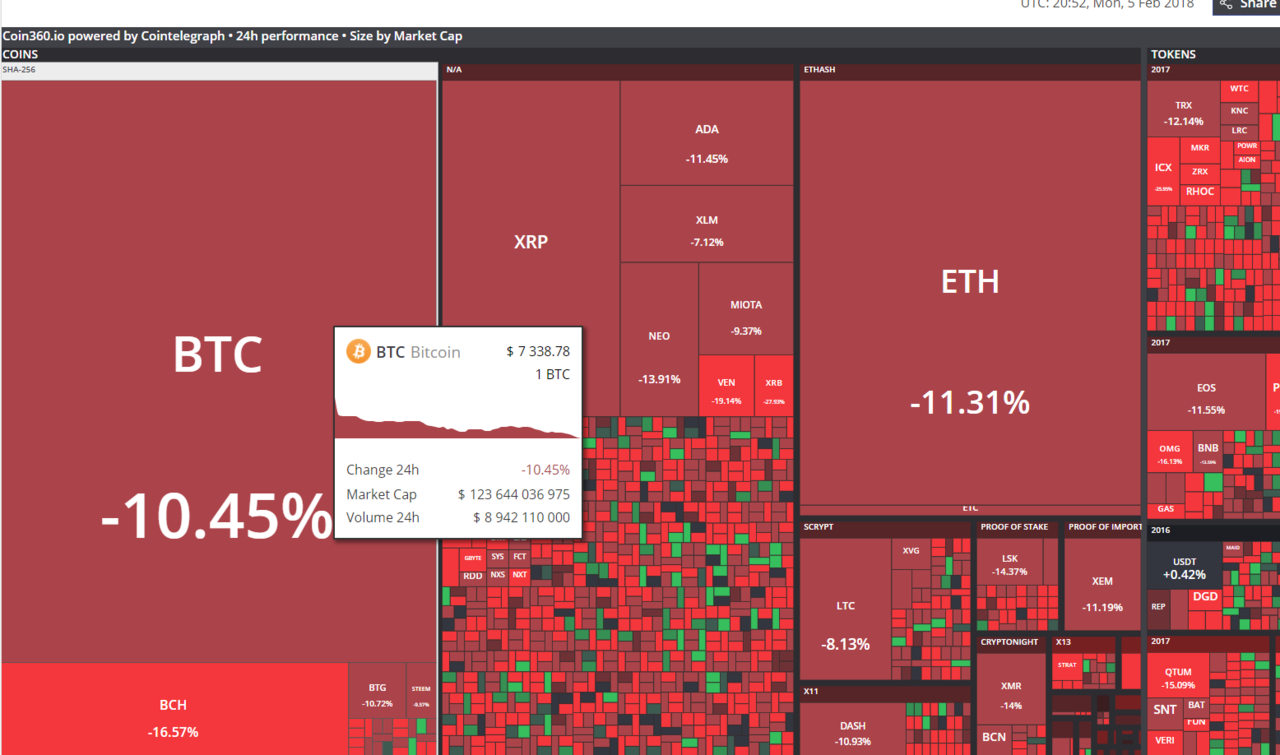

Has the bubble popped? Is Trump in big trouble if this continues? This is shortly after his PR stunt at the SOTU, boasting the stock market's health to his success.

https://www.npr.org/sections/thetwo-way/2018/02/02/582809604/dow-plummets-more-550-points

Log in to comment