Take-Two stock tanks, Duke Nukem Forever due by Dec. 31?

Stock plunges after dismal earnings report; SEC filing reveals 3D Realms has a $500,000 incentive to finish infamously delayed PC game by year's end.

Shortly after the stock markets closed yesterday, Take-Two Interactive announced a $50.2 million loss for its second quarter. Today when the markets reopened, the publisher took a beating worthy of that doled out in one of its more violent games. At the closing bell, its share was down $2.94, or 17.53 percent, falling to $13.83. The final figure was just $0.19 above the stock's 52-week low of $13.64, but the share value had sunk to $13.74 during the day.

But while traders panicked, analysts were more sanguine on Take-Two's fortunes. Friedman Billings Ramsey's Shawn Milne lowered his target price for the company $16 to $14, but maintained a "Market Perform" rating. UBS's Mike Wallace seemed indifferent to the news. "No excitement here," he said in a note issued today, in which he maintained his "Neutral" valuation of the company.

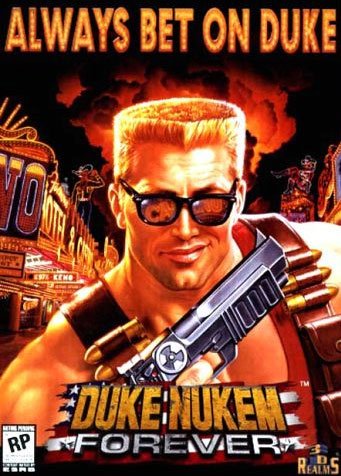

Of more interest to gamers was some major news buried in a 10-Q filing Take-Two issued to the Security and Exchange Commission (SEC) yesterday. Toward the bottom of the form in the "Notes to Unaudited Condensed Consolidated Financial Statements" subsection, was a major development regarding one of the most famous--or infamous--PC games of all time: Duke Nukem Forever.

According to the 10-Q, March saw Take-Two and 3D Realms renegotiate the original contract for Duke Nukem Forever, which began back in 1997. Under the original deal, 3D Realms was to receive some $6 million from Take-Two to develop the title. Now, the Texas-based developer will receive $4.25 million for the oft-delayed game.

"In March 2005, the Company [Take-Two] renegotiated a $6,000 contingent obligation due upon delivery of the final PC version of Duke Nukem Forever through the payment of $4,250 and issuance of a promissory note in the principal amount of $500," read the 10-Q, listing figures in thousands of dollars--i.e. $4,250 = $4.25 million. "The payment of the promissory note is contingent upon the commercial release of such product prior to December 31, 2006."

[NOTE: The second mention of the completion figure to be listed mistakenly as "$4,250" without the caveat that the 10-Q figures were in thousands of dollars, even though the original mention of the figure was correctly put at $4.25 million. GameSpot regrets the error.]

Got a news tip or want to contact us directly? Email news@gamespot.com

Join the conversation