The U.S. tax system is supposed to be progressive, meaning that wealthier households pay a larger share of their income to the taxman than the middle class and the poor. Yet after the Tax Cuts and Jobs Act of 2017, that's no longer the case: For the first time in a century, America's 400 richest families now pay lower taxes than people in the middle class.

That's according to an analysis of tax data by two prominent economists, Emmanuel Saez and Gabriel Zucman of the University of California at Berkeley, that is a centerpiece of their new book, "The Triumph of Injustice," to be published on October 15. Saez and Zucman, who have worked with the noted French economist Thomas Piketty to produce seminal research on inequality, also advised Senator Elizabeth Warren on the Democratic presidential candidate's plan to impose a wealth tax on ultra-rich families.

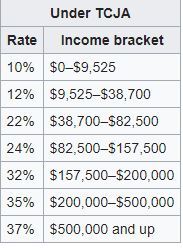

The tipping point came last year when the Tax Cuts and Jobs Act, which was signed into law by President Donald Trump at the end of 2017, took effect. While Mr. Trump vowed that middle-class families would be helped by the tax overhaul, experts say most working-class families saw only a minimal benefit, while the wealthiest citizens got the lion's share of breaks. In fact, Saez and Zucman argue, the Tax Cuts and Jobs Act turned the tax system on its head.

"In 2018, for the first time in the last hundred years, the top 400 richest Americans have paid lower tax rates than the working class," they write. "This looks like the tax system of a plutocracy."

...

Although advocates of low taxes argue that slashing rates on the rich and corporations boosts economic growth, there's little evidence for that. Instead, the U.S. is facing a number of risks by shifting to a more regressive tax system, the authors say.

For one, the federal government is losing out on a massive amount of tax revenue by slashing levies on the rich. Secondly, that lost revenue must be found elsewhere, which means the middle class and poor are likely to be stuck footing the bill.

But the most important reason, according to Zucman and Saez, is that the U.S. tax system is creating what they call an "inequality spiral." In other words, the rich are getting richer — that allows them to shape public policies to extract further tax breaks and other benefits, boosting their wealth and political clout.

Link

We've touched on this briefly in another thread on another topic which is now locked, and I thought this topic warranted it's own discussion. Do you support this effect of the tax cuts passed earlier in this administration? If not, do you still support the tax cuts overall? Or perhaps you'd like to see this trend amplified due to some perceived benefit from it?

Log in to comment