Grand Theft Auto and NBA 2K parent publisher Take-Two announced on Monday that it has agreed to acquire Zynga in a cash and stock deal valued at $12.7 billion. That makes it the largest acquisition in the history of video games by a large margin, the next closest being Tencent's $8.6 billion buyout of Supercell in 2016. The $12.7 billion deal is also significantly more than the $8.1 billion that Microsoft paid to acquire ZeniMax/Bethesda.

Looking outside of video games, it's three times as much as what Disney paid for Star Wars ($4.05 billion). For many, these numbers will come as a shock--the company behind FarmVille is worth almost $13 billion? But with huge growth expected from the casual and mobile gaming spaces, it's not as much of a surprise as you might think.

Making the deal all the more noteworthy is that Take-Two plans to pay a 64% premium on Zynga's stock price as of January 7, which suggests the GTA company is extremely bullish on the outlook for growth. In fact, and to put a specific number to the significance of the deal on Take-Two's bottom line, the company said this deal will lead to opportunities for $500 million annually over time that it didn't have before.

Importantly, the deal is not done, and it includes a "go-shop" provision whereby Zynga has 45 days to look for a better deal from a different company. Many may recall how Take-Two originally bid $994 million for Codemasters before rival Electronic Arts came in with a $1.2 billion bid that Codemasters ultimately accepted. During a call on Monday discussing this provision, Zynga CEO Frank Gibeau declined to comment further.

The eye-watering price tag is reflective of the current gaming market. Mobile gaming is more popular and lucrative than console/PC, so it stands to reason that a giant in the space like Zynga--even if its balance sheet hasn't been steady of late--would carry a premium price tag in the open market.

In 2020, NPD reported that there were more than 300 million people in the US and Canada who play mobile games, while every mobile game genre enjoyed a growth in revenue in 2020 compared to 2019. The top money-making categories for the year included puzzle, skill & chance, and strategy–all of which are areas that Take-Two would get a piece of with its proposed acquisition of Zynga.

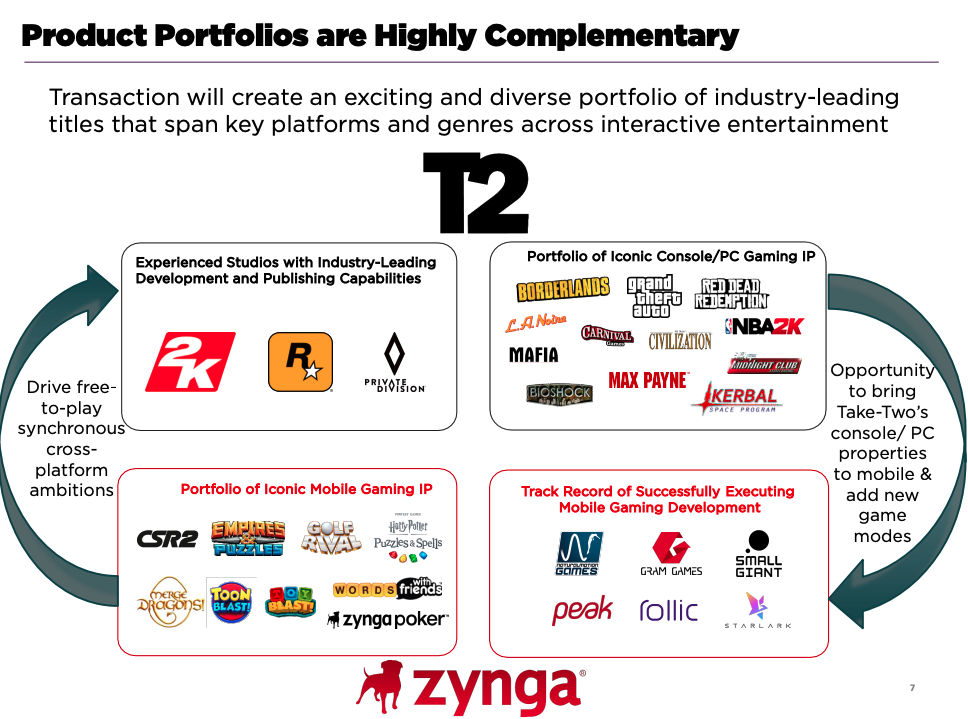

As part of the buyout, Take-Two management said it now has a "clear path" for bringing its console and PC franchises to mobile, though it remains to be seen if Red Dead or GTA will be playable on your phone anytime soon. While the specifics around individual product releases are unknown at this stage, following the money shows how serious Take-Two is with its new, more diversified approach. Thanks to Zynga, along with Take-Two's previously established mobile games (including Dragon City, Monster Legends, Top Eleven, and WWE SuperCard), the company expects 50% or more of its revenue to come from mobile in the years ahead, up from about 10% right now, Wedbush Securities analyst Michael Pachter tells GameSpot.

"Take-Two has a long history of being a 'hands off' manager, and Zynga management is excellent. The deal transforms TTWO from 10% mobile to over 50%," Pachter said about the deal. "Zynga is one of the best mobile publishers out there, with a deep pipeline and a base of very successful games. Zynga management will assist Take-Two in creating mobile games from Take-Two IP and should continue on the growth path Zynga had established before."

The $9.861 per share that Take-Two is proposing to pay for Zynga's outstanding stock is actually a bargain, according to Pachter, who modeled a $12 target on Zynga's stock price.

In acquiring Zynga, Take-Two would take ownership of a giant catalog of popular mobile franchises such as FarmVille, Words With Friends, Zynga Poker, CSR Racing, Empires & Puzzles, Harry Potter: Puzzles & Spells, Toon Blast, and Toy Blast. Take-Two would also assume ownership of Golf Clash, from StarLark, a studio that Zynga itself paid more than $500 million to acquire in 2021. Take-Two even gets its foot in the door for the massive Star Wars series through the free-to-play Nintendo Switch and mobile game Star Wars: Hunters, which comes from Zynga and releases this year.

Outside of games themselves, Take-Two would receive Zynga's technology and data pipelines, including the mobile game programmatic advertising platform Chartboost, which Zynga acquired for $250 million in 2021. On a call, Zelnick mentioned that Chartboost wouldn't be duplicative of any service that Take-Two already has in this department--because it doesn't have one. Additionally, Take-Two's buyout of Zynga gives it access to Zynga's NFT/blockchain technology pipeline, and though it is early days for what this might look like in practice, Take-Two is bullish on the possibility of NFTs and "play-to-earn" technologies becoming a significant element of the gaming landscape in the future. On a call, Gibeau said it's "early days" for NFTs and blockchain at Zynga, but there is a belief within management that it could become the next big thing.

Piers Harding-Rolls, a research director for games at Ampere Analysis, tells GameSpot that the 64% premium it would pay for Zynga's outstanding stock might seem like a lot. But it's representative of Take-Two showing up to the table with a strong offer given what other bids might be out there that Zynga could consider with the deal's go-shop provision.

"With the option for Zynga to consider other offers, Take-Two will have been wanting to put its strongest foot forward to secure the deal. Zynga gives Take-Two a substantial turn-key mobile business, which can support its expansion in the fastest growing part of the market," Harding-Rolls said.

If Take-Two can close the deal, it would generate a mobile business for the company that is "much more comparable" to those operated by longtime competitors EA and Activision Blizzard, Harding-Rolls said.

"The acquisition allows Take-Two to diversify its audience immediately and expand its global reach. It gives the company stronger capabilities in running live-service titles and user acquisition advantages through Chartboost," Harding-Rolls said.

The analyst also observed that there could be "interesting synergies" between Zynga's sports games and Take-Two's for Golf Rivals and PGA Tour 2K. After a year off in 2021, the professional golf sim is coming back in 2022, and it'll be the first new release since Take-Two signed golf legend Tiger Woods to be an advisor on the project.

Take-Two's Zynga deal is also about helping it expand its geographical reach. The company mainly does business in the West--a massive market, to be sure, but only a slice of the global pie--and buying Zynga gives Take-Two the opportunity to expand into markets where Zynga already has a strong presence, including India and the Middle East.

"Can these cultures work together and be successful? Combining all these entities will be a challenge." -- Piers Harding-Rolls

As with any big buyout, questions remain about the impact on people. In its announcement, Take-Two said it will recognize $100 million in "annual cost synergies" related to the acquisition due to the combining of "complementary businesses" between Take-Two and Zynga. Whether or not there will be any layoffs related to the acquisition, however, remains to be seen. GameSpot has followed up with Take-Two in an attempt to get more details.

Also of note: It remains to be seen what Take-Two's deeper investment into the mobile space with its proposed acquisition of Zynga might have on the company's more traditional development studios and structures for console and PC games. Take-Two's next big console release is Grand Theft Auto V for PlayStation 5 and Xbox Series X|S in March 2022. Beyond that, 2K's new studio Cloud Chamber is making the next BioShock game for console, while former Dead Space and Call of Duty boss Michael Condrey is heading up a new team in Silicon Valley that is supposedly making a multiplayer game.

BioShock creator Ken Levine's team at Ghost Story Games is making a new title for Take-Two as well that will presumably release across console and PC if it can overcome its well-documented development challenges. Beyond that, Rockstar is reportedly working on the next Grand Theft Auto game right now, which could feature a Fortnite-style evolving map. This is to say that Take-Two continues to invest in console and PC projects while simultaneously embracing mobile in a bigger way.

It's not just Take-Two that is investing heavily into the mobile gaming market. Activision Blizzard is pushing deep into the category, recently announcing that it plans to bring every one of its franchises to mobile over time. On the more immediate horizon, the company created a new team, Solid State Studios, to develop a brand-new Call of Duty game for mobile. Electronic Arts, meanwhile, paid $2.1 billion to acquire Glu Mobile, the makers of the hit Kim Kardashian mobile game. "Mobile is the biggest platform in gaming today, and we're committed to growth," EA CEO Andrew Wilson said. Nintendo is also involved in the mobile space, though the company appears to have scaled back its plans in recent years following the launch of titles like Fire Emblem Heroes, Mario Kart Tour, Super Mario Run, and Animal Crossing: Pocket Camp.

Take-Two is very clearly optimistic about its roadmap for the future, but that path forward might be rocky. In addition to the aforementioned uncertainties regarding the $100 million synergies, Harding-Rolls observed that there are cultural challenges at play in this deal.

"There are a few challenges a combined entity faces. One is cultural. While both public companies, Take-Two is often more wait and see when it comes to innovation (part of the reason behind its less developed mobile games business) whereas Zynga can be considered more on the front foot when it comes to innovation," Harding-Rolls said. "Can these cultures work together and be successful? Both companies have made a number of acquisitions during the last 18 months. Combining all these entities will be a challenge."