The industry is bracing itself for another seismic shift. This time the threat is twofold: both the massive, disruptive change possible with new cloud-based technologies, and a new entrant into the market as Google prepares to launch its Stadia platform. Microsoft has its own plans to offer streaming through a cloud service, xCloud, as a complement to its usual console services. But how much will cloud gaming shake up the industry, and how quickly?

Currently, cloud gaming has three major hurdles to overcome: availability of high-speed internet, bandwidth data caps, and the public perception of digital ownership. To glean insights on the technical obstacles facing cloud gaming, GameSpot spoke with David Linthicum, a cloud computing expert and Chief Cloud Strategy Officer at Deloitte Consulting.

High-Speed Availability

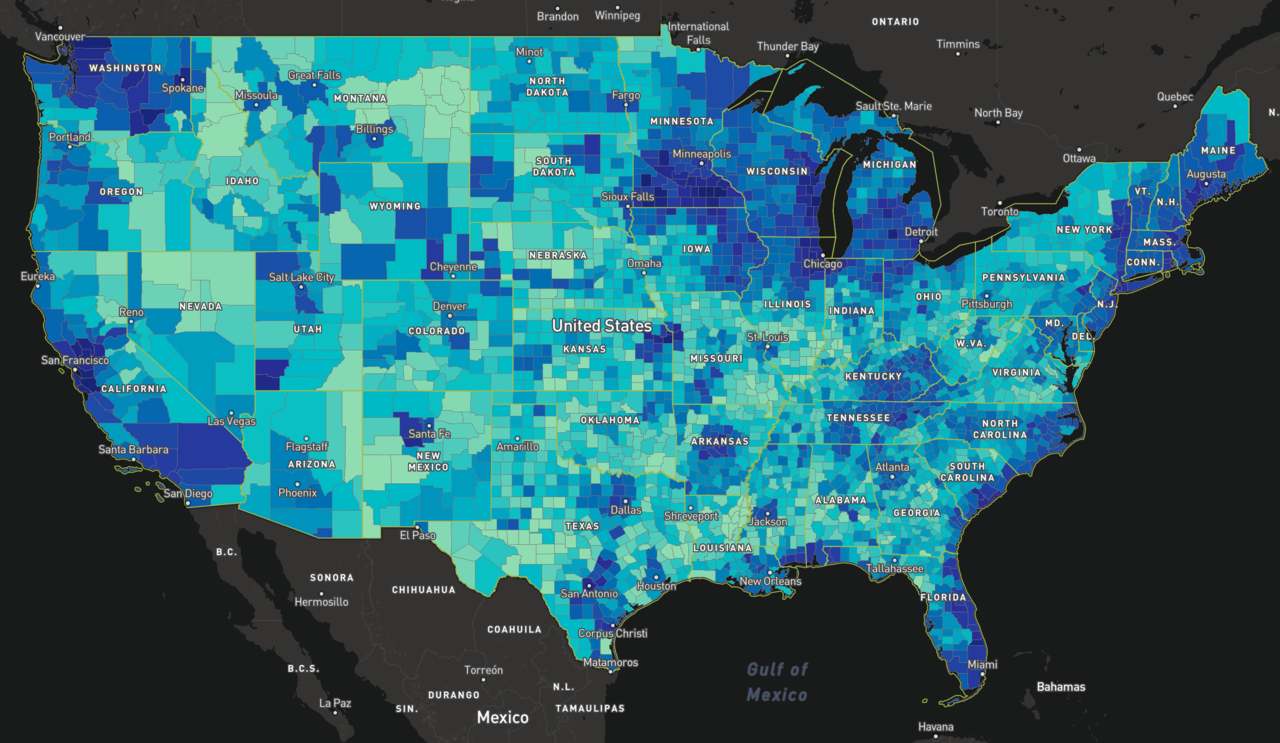

One of the foremost threats to cloud gaming dominance is the simple limitations of the market. A recent NPD report found that roughly 31% of households in the United States lack any kind of broadband access. Though the report was bullish on the coming advent of 5G to bring broadband to rural markets, any new product is at a disadvantage if almost one third of the population can't use it from the outset.

"The so-called digital divide, between those that can or cannot make the best use of the internet, can be clearly felt in rural markets where the lack of broadband impacts everything from entertainment to the educational system," NPD connected intelligence president Eddie Hold said. "And even the state level data masks the underlying reality that in the most rural markets in America, less than 20 percent of households have a broadband connection."

However, there is reason for some optimism even in these numbers. The same report found that 43% of rural households own a streaming media player--nearly the same percentage as households nationwide--even without broadband access.

That may be, in part, how broadband access is defined. Many colloquially think of broadband access as the required speed to run streaming services. In reality, that isn't quite the case. The US Federal Communications Commission defines broadband speed as greater than 25Mbps, but the actual speed requirements for streaming video are much lower. Roku, for example, recommends only 9Mbps for HD streaming content. And while the FCC broadband map shows much of the rural United States having only one or two broadband providers offering high-speed internet, very few areas show no options at all.

Any other concerns regarding broadband penetration would appear to be a matter of timing. Google may not reach high market penetration immediately, but if the company is patient, the first-mover advantage could pay off.

"Going forward, I think if we get in a time machine and go forward five years, I think [game platforms are] all going to be in the cloud, just because of ease-of-use," Linthicum said. "For now, we're going to see hitches with pricing, impact on gamers who actually run software and them being able to monetize. I think the big thing's gonna be latency. I was an early Netflix adopter and that thing would have all types of issues even in high-bandwidth environments, but eventually they fixed it. I think people are pretty forgiving around new technology and they always understand that things are going to be continuously improving."

Data Caps

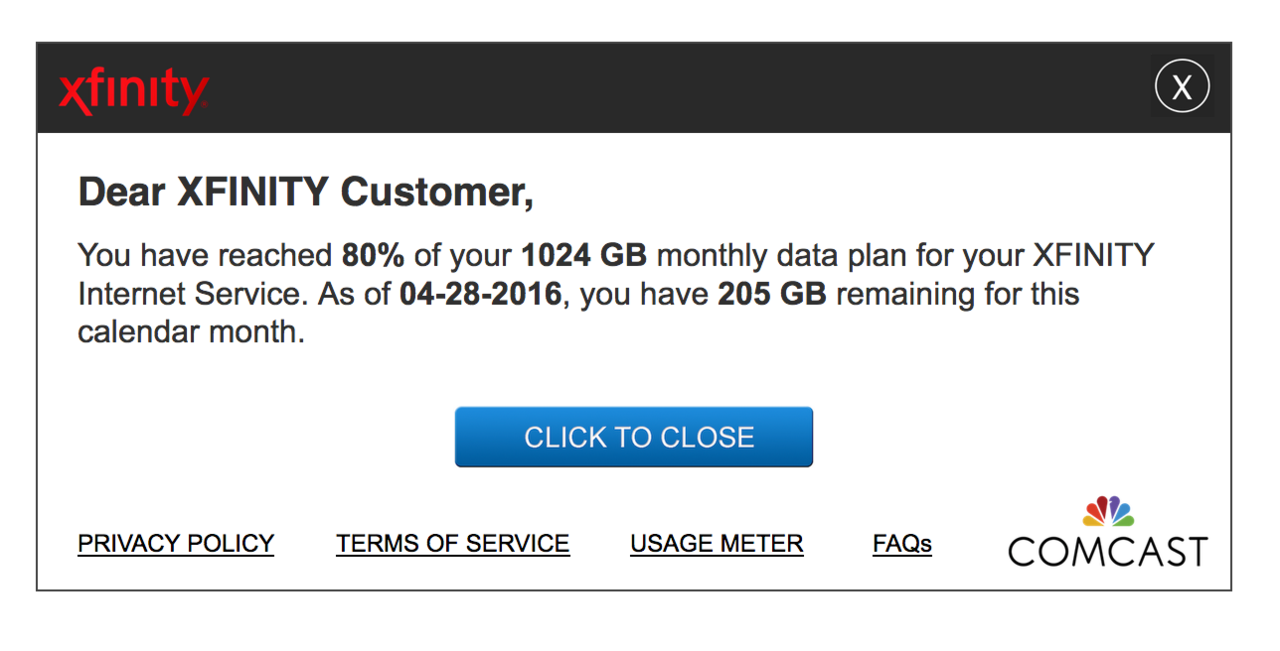

Even for power users with a high-speed connection, though, cloud gaming service introduces a secondary risk: data caps. If users are slapped with high overage rates simply for playing games, it could kill Google Stadia and similar services in the crib before the technology rises to meet the demand. Google VP Phil Harrison addressed the question of data caps in an interview with GameSpot, suggesting that ISPs would respond to consumer needs.

"Historically, ISPs have demonstrated that they are very responsive to [consumers' needs]," Harrison said. "When music streaming became popular, they lifted the bandwidth limit. When music streaming migrated to YouTube and Netflix streaming, once again the limits went up, and we expect that the limits will continue to rise over time. Partly driven by consumer demand, but also frankly, ISPs are in competition. There is a market dynamic, you know, that we believe will help continue to deliver a great service for gamers."

That answer didn't satisfy some awaiting Stadia, especially upon word that the company had revised its estimates upward--from 30Mbps for 4K to 35Mbps. Some watchers multiplied that figure into an hour of play, coming up with 15 GB per hour. That roughly squares with Linthicum's prediction that a server-based gaming platform would demand roughly twice the bandwidth of a 4K movie, which Netflix estimates at 7 GB per hour.

"We haven't put a meter on Stadia," Linthicum said. "But I suspect that for home-based networking systems everybody is going to be well below it. It looks like they're going to, in essence, put metering embedded with the Stadia-based system so people can see how much data they're using.

"I think people are always a little misinformed about how much information actually comes down via the systems like Netflix or another streaming service," he continued. "It uses less data than people typically think it uses and I suspect that may be the same here. With that being said, we're dealing with people who have all sorts of bandwidth restrictions and capping and some people are still using hotspots and things like that. Obviously you have to keep an eye on how much data you are using to make sure you don't go over."

Linthicum said that the additional data is due to the need to be more aware of latency to maintain the gaming experience, but stressed that this is an educated guess without having metered the service.

Assuming that roughly 15 GB per hour of play is accurate, though, it adds up fast. An avid gamer who is the most likely early adopter for Stadia might play 10 hours or more per week. That's 600 GB of data per month, just spent on video games, and not counting any other activities that might impact your bandwidth usage like movie streaming. By comparison, Internet Service Provider Comcast recently reported that median customer data usage had reached 200 GB per month.

It's easy to see how gamers could blow past the bandwidth limitations quickly and get hit with overage charges. But like Harrison, Linthicum says he expects that ISPs will work to capitalize on the opportunity with consumer-friendly packages, rather than simply punish them with extra fees.

"I suspect [ISPs] want to know what's coming down in terms of the bandwidth requirements and the behavior of Stadia and other gaming servers, cloud-based gaming services that are going to be coming out and making sure they are able to adjust expectations accordingly. Because they obviously make money from this if people increase bandwidth or increase speed. That costs additional dough and so they want to make sure they're marketing correctly but also make sure they're accommodating the needs of the users. I think we're going to see some bundling of systems and some marketing campaigns show up around this."

Digital Ownership

The biggest obstacle to cloud game streaming may not be technical, but perceptual. The community may not be ready to accept a streaming future in which they don't own their digital purchases. Though most digital goods are merely licensed by consumers, the public often thinks of content stored on a local device differently than streaming. Consider the difference in mindset during the era of vast MP3 collections versus widespread adoption of services like Spotify. While customers largely never actually owned their iTunes MP3 collections, they had an inherent sense of ownership, whereas Spotify subscribers largely understand themselves as paying for access to an ongoing service.

Game prices on Google Stadia will match those of new physical copies, which may exacerbate the perceived differences between physical goods and digital streaming. Similar to Spotify, Netflix segued a successful DVD rental service into one of the largest video streaming services around, but that was at a single low, all-you-can-eat price point.

Google is very explicitly not doing that, and it has stated that its subscription service with the Stadia Pro will only include one new game per month. A more comparable model to Netflix's approach might be Microsoft's popular Game Pass service, if wedded to streaming as the delivery mechanism. But Microsoft has not given any indication as to whether or when that might happen, and Xbox boss Phil Spencer told GameSpot that he believes dedicated cloud gaming is "years away from being a mainstream way people play."

However, where it may sacrifice in appeal to the core gaming audience, it could make up by broadening the appeal of video games. The average PlayStation 4, Xbox One, or power-PC owner may not see a reason to purchase a streaming game for $60, but that audience already owns the hardware to play it natively. The in-roads awaiting the game streaming future could come from consumers who have enjoyed games in the past or occasionally, but haven't been able to justify the cost of dropping hundreds of dollars on hardware every few years.

"We're going to get gamers that weren't traditional gamers, even guys like myself that do it every once in a while, but don't really habitually game on a daily basis," Linthicum said. "But if it's easy for me to just go ahead and take a few minutes and click on something within YouTube and have something pop up, that's a very rich experience. The net new users, I think, is probably going to be their biggest market growth: traditional non-gamers that are going to find Stadia just compelling, because of ease-of-use."

Microsoft seems suited to compete in this market as well. It has accented that it wants to use its xCloud platform to bring game streaming to a wide array of devices, and Google will begin introducing Stadia streaming to more Android phones sometime in 2020 after its initial premium launch. Once both services are up and running, we may have a better idea of whether the democratization of video games to anyone with a screen is enough to overcome the pitfalls.